The Russia-Ukraine Donbass conflict and the threats to the oil and gas industry

How the Donbass conflict between Russia and Ukraine impacts the oil and gas industry.

Intelligence Fusion’s monitoring of the war in Ukraine’s Donbass region has seen more than the increasing ceasefire and withdrawal violations between Ukraine’s Military and Russia-backed separatists, the Donetsk People’s Republic (DPR) and Luhansk People’s Republic (LPR) militias (Pratten, 2020; Pratten and Intelligence Fusion, 2021). As 2021 has progressed, several developments have featured the oil and gas industry both within the Donbass region, wider Ukraine, and internationally; especially in Russia.

The purpose of this report is to provide a brief analysis on the war in the Donbass region and the impacts to/from the Oil and Gas Industry. By looking at the current state of the region, and providing an overview of Ukraine’s oil and gas sector, this report will assess what lies ahead for the war and the oil and gas industry.

What's happening in the Donbass Conflict?

As shown in Figures 1 and 2 the majority of incidents of direct conflict remain within Donetsk and Luhansk Oblasts and the trends surrounding these incidents remain predominantly unchanged as per previous reports. However, incidents outside the region are beginning to contribute to the conflict as shown by the growing hot spots in Kyiv, the Black Sea, Moscow and St Petersburg. These incidents predominantly consist of strategic level developments such as espionage, naval activity, weapons development/deployment as well as diplomatic and economic issues; the most notable being upcoming completion of the Nord Stream 2 pipeline – scheduled for 23 August 2021 – running from Russia to Germany through the Baltic Sea (AFP, 2020; Intelligence Fusion, 2021; Radio Free Europe/Radio Liberty, 2021; IF-Europe, 2021a, 2021c, 2021e, 2021b, 2021f, 2021d, 2021g).

Figure 1 - Incidents relating to the Donbass Conflict since 1st January 2021 (Source: Intelligence Fusion)

Figure 2 - Incidents relating to the Donbass Conflict since 1st January 2021 (Source: Intelligence Fusion)

The increasing amount of ceasefire and withdrawal violations do not appear to be causing a return to the hostility which existed in 2014; the situation appears to see the Donbass conflict as “Europe’s forgotten war” (Mikovic, 2021). Having said that, the potential for a return to that kind of situation continues to be a possibility due to continuing efforts to hinder monitoring efforts of the Organisation for Security and Cooperation in Europe (OSCE) through electronic jamming of their Unmanned Aerial Vehicles, deployment of long-range weaponry – the BM-30 ‘Smerch’ multiple rocket launch system now being the longest range weapon in the region – and gradual increase of using 120mm and 152mm artillery by both sides. Both Donetsk and Luhansk Oblasts remain unsuitable for any kind of activity outside of military operations (Intelligence Fusion, 2021; Mikovic, 2021).

Overview of Ukraine's Oil and Gas Sector

Ukraine has immense potential for investment with its vast oil and gas resources, ranking second across Europe for gas reserves. Shown in Figure 3 below, these resources are divided into three major regions: the Dnipro-Donetsk basin, the Carpathian region in western Ukraine, and the Black Sea and Crimea region. The Dnipro-Donetsk basin holds the majority of these resources. In terms of production, natural gas takes up 89%, oil 7.9%, and gas condensate takes up 3.1% in terms of hydrocarbon production (U.S. Department of Commerce, 2021; Renkin, 2019; The Energy Consulting Group, 2015).

Consequently, the Ukrainian government considers the oil and gas industry as a strategic sector; with the majority of production belonging to state-owned companies accounting for approximately 74%, domestic private firms accounting for 18% and other private firms accounting for 3% of production. Additionally, Ukraine has numerous pipelines enabling Russian oil and gas to be pumped into Europe via Ukraine as shown in Figure 4. Ukraine receives an approximate US$1.5 billion in transit fees from Russian gas being pumped through these transmission lines (Renkin, 2019; Intelligence Fusion, 2021; Schuler, 2014; Yermolenko and Panchenko, 2021).

The impact of the Donbass conflict on oil and gas

Russia’s invasion and continued possession of the Donbass region and the Crimea Peninsula since March 2014 has subsequently caused significant, strategic level damage to Ukraine’s economy. Looking at Figures 5 and 6, the fighting between Ukraine and the DPR/LPR in the southern edges of the Dnipro-Donetsk basin, along with its proximity to Russia-Ukraine borders, would appear to deny Ukraine the full use of its largest oil and gas basin. Furthermore, the possession of Crimea by Russia would appear to deny Ukraine access to its Crimea Oil and Gas basin as well as use of its Deepwater Licences due to the risk of Russian naval activity in the Black Sea.

Adding to the above problems is the impact of Russia’s invasion on Foreign Direct Investment (FDI) in the industry. After the conflict began in 2014, oil and gas firms Royal Dutch Shell and Chevron withdrew their investments in the Yuzovsky and Olesska shale gas blocks, affecting even the Carpathian basin despite it being insulated from the fighting. As shown in Figures 4-6, the withdrawal of these investments has amplified the impact of losing the Dnipro-Donetsk basin and the Crimea basin (Cunningham, 2014; Russia Today, 2015; Alexeev, 2014; Central Intelligence Agency, 2021; Intelligence Fusion, 2021).

Figure 5 - Donbass conflict hotspots, oil and gas resources, and major gas transmission lines (Source: Intelligence Fusion, Outside the Beltway Blog, and The Energy Consulting Group)

Figure 6 - Donbass conflict hotspots and controlled territories (Source: Intelligence Fusion)

Furthermore, ongoing monitoring of the conflict has indicated that mining, oil and gas infrastructure continues to be affected by ceasefire violations. Shown in Figure 7, the actual incidents themselves and the growing threat of mines and unexploded ordnance (UXO) pose a threat to current infrastructure and personnel now and in the future. Adding to this problem is reporting which indicates that from 2024, Russia could end its contracts with pumping gas through Ukraine – denying Ukraine billions in revenue – based on the upcoming completion of the Nord Stream 2 pipeline which will bypass Eastern Europe, rendering many of the current pipelines largely irrelevant to Russia’s economic interests.

Figure 7 - Incidents relating to oil, gas and mining in Ukraine (Source: Intelligence Fusion)

Finally, recent reports suggest the DPR intends to bolster the local mining economy and has – allegedly – been exporting goods to countries which include Russia, the UK, Japan, Ukraine, Poland, Belarus, Lithuania, Latvia and Estonia. These claims of ‘exporting goods’ are more than likely to be selling goods via the black market to criminal networks – given the DPR is fighting against Ukraine – rather than legitimate trade with other countries. Given the crime incidents which have been logged which are linked to or caused by the current war – as shown in Figure 8 below – the environment in the Donbass region would appear to be conducive to such trading. Such trading will bolster the DPR’s revenues to continue fighting and increase Russia’s access to natural resources at the expense of Ukraine’s economic health and legitimate operations in the oil and gas sector (Radio Free Europe/Radio Liberty, 2021; Intelligence Fusion, 2021; AFP, 2020; Yermolenko and Panchenko, 2021).

Figure 8 - Incidents relating to crime from the Donbass conflict (Source: Intelligence Fusion)

Analysis/Assessment

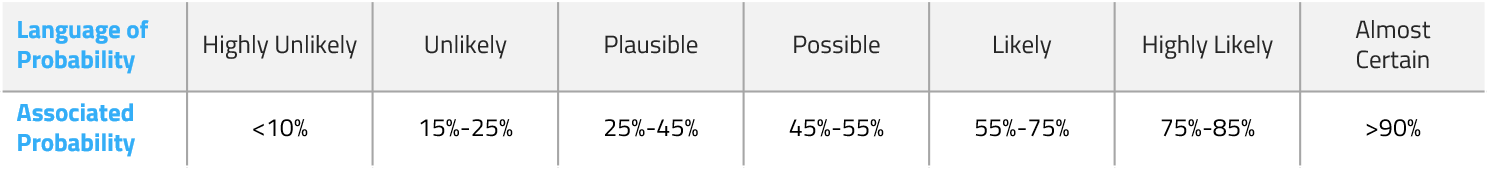

The oil and gas sector in Ukraine faces difficult times ahead due to the war in Donbass. The ceasefire and withdrawal violations will continue with reports indicating a likely increase of the tempo and intensity of these incidents. However, this increase is highly likely to continue at a gradual pace which will see the current stalemate remain; making an end to this war unlikely for the time being. This continued state of affairs will see Ukraine’s oil and gas sector remain limited to operations in the Carpathian basin. Oil and gas infrastructure in the Dnipro-Donetsk and Crimea basins will also face continued threats of infrastructure damage and – should the war end – this infrastructure will have the threat of UXO’s for quite some time; adding to the threat to the oil and gas infrastructure will be the upcoming completion of Nord Stream 2 which will reduce Russia’s need for gas transmission lines via Ukraine.

Making matters more difficult will be plausible efforts by the DPR to begin an illicit oil and gas trade with Russia – based on its current efforts towards coal mining – and Russia’s access to the resources in the Black Sea and Crimea Peninsula. Combined with the potential for Russia to cease pumping natural gas to Europe through Ukraine from 2024, it is plausible the oil and gas sector in Ukraine will see an increased presence of black market activity in the region as these resources would appear to have too much potential to be ignored; creating increased reputation damage to the oil and gas sector in Ukraine.

References

Russia-Ukraine Conflict Summary 2022: What's happening now?

What is happening in Ukraine now? We’ve created a dedicated page for the Russia-Ukraine conflict – both in the Donbass region, and the wider tensions following the reported Russian troop build-up around Ukraine’s borders from November 2021 onwards. Here you’ll find regular updates on the latest developments in the Ukraine crisis as well as further context surrounding the situation.

Head there now for the latest Russia-Ukraine conflict summary.