Pipeline Security in the Nagorno-Karabakh Conflict

Overview of the Conflict

The recent escalation in the Nagorno-Karabakh conflict between Azerbaijan and Armenia has remained limited from a geographic perspective, in that the conflict has mostly been restricted to the Nagorno Karabakh region itself. Consequently, fighting has been concentrated in key regions along the border, such as around the population centres of Terter in the north of the region, and in the Jabrayl and Fuzuli regions in the south. The deployment of long range artillery and drones has also allowed both sides to target military and civilian positions relatively far behind the front lines. Despite open hostilities, the internationally recognised border between Azerbaijan and Armenia to the north of the Nagorno-Karabakh region has only seen several clashes and incidents and heavy fighting has not been recorded, suggesting a reluctance from both sides to allow the conflict to engulf a larger geographical area.

The international backers of the respective belligerents have played an important role in the conflict’s international relevance so far, with Azerbaijan being backed by Turkey, and Armenia by Russia. Russia’s role in the conflict has been cautious and restricted, particularly when compared to their counterpart, Turkey. Russia’s subdued response to the fighting at first glance appears surprising, with both Azerbaijan and Armenia being in a region often referred to as ‘Russia’s backyard.’ However, closer inspection shows that despite Russia being tied to Armenia militarily via the Collective Security Treaty Organisation (CSTO), Russia has worked to improve relations with Azerbaijan in recent years. Russia appears to have recognised that total alienation of Azerbaijan would leave the door open to other backers such as the US, the EU or China, the latter of which regards Azerbaijan as an important point in the Belt and Road Project. As a result of this recognition, diplomatic meetings between Russian and Azerbaijani officials have begun to occur more frequently in the last 20 years as well as limited military cooperation.

Turkey on the other hand has been more proactive although has stopped short of direct military involvement. Turkey has provided an unknown number of the Bayraktar B2 attack drones to Azerbaijan, the likes of which have featured heavily in video footage released by the Azerbaijani MoD. The Bayraktar drone has become a well-known name in modern conflict, seeing extensive action in Libya as well as operations in the Kurdistan region in Northern Syria and Iraq. Turkey is also believed to have supplied an unknown number of fighters from Syria to Azerbaijan via a private military contractor. The fighters have been recruited from the Syrian National Army (SNA,) a loose collection of militias opposed to the Syrian Government, active across northern Syria. Increasing evidence has been seen to confirm the presence of Syrian fighters in the Nagorno Karabakh region, although it should be noted that little is known about their role in the fighting beyond anecdotal reporting.

Oil and Gas Security Amidst the Fighting

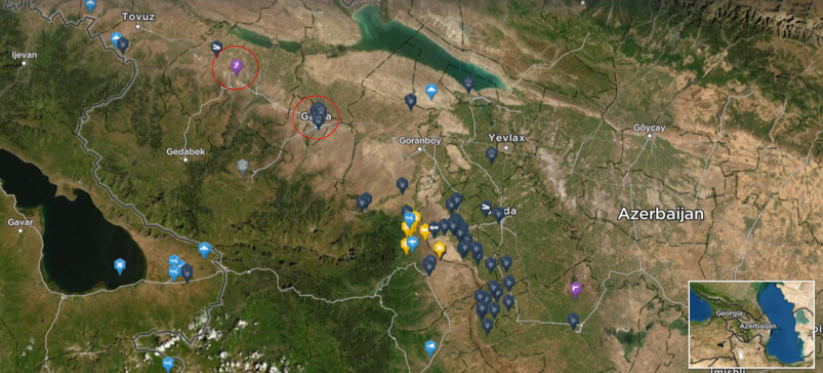

Whilst the geographical spread of the fighting has been limited, the proximity of key oil and gas pipelines and facilities in the area have raised significant security concerns within the sector. Fears appeared to be confirmed when the Baku-Tbilisi-Ceyhan (BTC) pipeline (operated by British Petroleum) was allegedly targeted by Armenian forces using tactical ballistic missiles (note: the claim was denied by Armenia.) A second high profile incident was recorded in mid-October, when Azerbaijan claimed that Armenian forces targeted the Baku-Novorossiysk pipeline north of Baku, far behind the frontlines, again the claim was denied by Armenia.

If the claims were indeed true, neither attack has caused significant damage to either pipeline, meaning production and output saw very little impact. With the recent escalation still be relatively young, both sides are wary of pushing the accepted boundaries of the fighting beyond what already exists by targeting civilian economic assets. However, a prolonged conflict has the potential to change this, and would significantly increase the threat of pipelines being targeted as the economic assets of both sides begin to play a more important role to sustain their respective militaries. The BTC and Southern Caucus Pipeline (SCP) in particular present a vulnerable target, with parts of them being buried just 30-40km from the fighting.

Azerbaijan has much to lose if pipelines were to be targeted as part of a strategic campaign, as oil and gas account for 80% of the country’s exports. Pipelines damaged by an explosion can be repaired easily, as seen in Turkey where pipelines are frequently targeted by Kurdish rebels. A deliberate sustained targeting of Azerbaijan’s oil and gas network would stretch resources, making repairs difficult and could pose the risk of drawing more foreign states deeper into the conflict on both sides. Azerbaijan acts as an important hub for oil and gas flowing into European and regional markets, ensuring that multiple countries are impacted by changes in the situation. Furthermore, the targeting of pipelines and the subsequent impact it would have on Azerbaijan’s economy would likely be seen as a major escalation, both political and military, in an already volatile situation, inviting retaliation in kind.

With this in mind, Armenia appears (at the time of writing) wary of the blowback from a strategic campaign aimed at targeting pipelines if it were to occur. Such reservations on both sides and a reluctance to broaden the conflict exist at the time of writing, but other factors may occur which could render such calculations obsolete. For example, a significant territorial gain such as an Azerbaijani capture of the entire Nagorno-Karabakh region or a series of decisive victories for Armenian forces in key areas may shift the political and military situation, forcing one side to take the choice of escalate the conflict to bring more assets to bare, or lose. The current Azerbaijani offensive in the south in the Fuzuli-Jabrayl regions along the Iranian border has seen Azerbaijan claim to have captured a number of villages, although whether the offensive can be sustained, and whether it is enough to change Armenia’s apparent reservations regarding the broadening of the war to economic output is yet to be seen.

Conclusion

At the time of writing, fighting continues along the border area, with Azerbaijan making limited gains, particularly in the south along the Iranian border. Fears of extensive targeting of oil and gas pipelines have for the time being not been fully realised, and oil and gas markets have reflected this by remaining largely stable throughout the conflict. As noted in the report, the current situation in which both sides appear reluctant to escalate is expected to prevail until a significant shift in the battlefield situation occurs. With warfare being unpredictable, such a shift is possible, but mounting pressure from the international community to approach peace talks, dwindling stocks of military hardware, economic impact and heavy casualties are expected to bring both sides to a ceasefire agreement.

The 24/7 team at Intelligence Fusion report, follow and update incidents across the world. To find out more about how we can help you better protect your people, assets and reputations, speak to a member of the team today.