Rare Earth Elements (REEs): Essential Resources, Global Supply Challenges, and Future Prospects

Rare Earth Elements (REEs) are essential for modern technologies such as electronics, renewable energy, and advanced materials. Their global supply chain, largely dominated by China, poses significant geopolitical and economic challenges for the world.

Rare Earth Elements (REE) - What are they?

There are 17 Rare Earth Elements (REE) – 15 lanthanides plus scandium and yttrium. As witty geologists may joke, they are also neither rare nor earth. Like other natural resources such as lithium, coltan and a host of other “strategically vital minerals,” they have become utterly indispensable to almost all forms of modern technology on which the global economy is built. Of the 17 elements, the lanthanides are regarded as more important, and these are further split into light (LREE) with atomic numbers 57 to 62, while heavy (HREE) are numbered 63 to 71.

What are they used for?

REEs are used across the entire swath of high-end technology. Tiny amounts are present in almost all consumer electronics, from phones to laptops. Some are used for LCD screens, while lanthanum is used in around 50% of camera lenses. Most notably, REEs are vital to the so-called “green” technologies intended to replace our dependence on fossil fuels – large wind turbines use two tonnes of high strength-magnets composed of around 30% REE-like neodymium. Likewise, around 20kg are used in the batteries and motors of an electric vehicle (EV) alone, while dysprosium and praseodymium are prevalent in photovoltaic (solar) technology. REE can be used to lighten and strengthen metal alloys or make them suitable for use in extreme temperatures, such as the use of praseodymium and magnesium alloys to make jet engine components. In short, despite their small production amounts, REEs are indispensable to the modern world of computing, communications technology, energy production and metallurgy.

We should also bear in mind that, unlike many commonly used metals, our knowledge and use of REE may only just be beginning. While copper was first used around 10,000 years ago and is still of vital importance today, research into the uses of REE only really began in the 1940s, and the limits of their use have not yet been explored.

Who has them?

China is by far the largest REE producer in the world, with reserves currently estimated at 44 million tonnes – around 40% of the global total. Vietnam has around 22 million tonnes, slightly ahead of Russia. Brazil has half that, followed by India and Australia. Greenland (see below) is also in the top ten. These figures can be somewhat misleading, though, as the presence of REE does not necessarily mean they are in sufficient concentrations to be economically viable. Sensational reports that X many millions of tons of REE have been discovered in Y country should be tempered with questions over the viability of extraction and refinement. This list also leaves off inconvenient, difficult-to-quantify deposits like those believed to be in North Korea or war-torn Myanmar, where Chinese companies have long partnered with local armed groups or corrupt military strongmen to exploit areas like northern Kachin State.

The presence of exploitable deposits does not mean a country controls their own supply. As with lithium, China has taken advantage of Western companies’ willingness to outsource, their governments’ willingness to let them, and large government subsidies to not only position itself as the leading producer of REE ore but to absolutely dominate their refinement and processing. While it has reduced slightly in recent years, China controls around 85-95% of all REE production. Even ore mined in the revived Mountain Pass mine in California is shipped to China for refinement, where decades of experience and investment, along with a comparative disregard for environmental concerns and worker conditions, have allowed the PRC to control virtually the entire global supply of refined REE.

Why the concerns?

Handing China a near-monopoly over REE production may have benefited the profit margins of many Western companies and allowed the devastating environmental costs of the pursuit of “green” technologies to be off-loaded to the developing world, but it has also given China control over these vital resources far in excess of what OPEC has enjoyed over oil production. Devotees of the Market may argue that this is not an issue, that restricting supply would damage the Chinese economy as much as anyone else’s, and that far-off environmental damage and anti-market practices by China are worth the trade-off for cheap REE and affordable electronics. They are, in part, correct – when China stopped the supply of refined REE to Japan without warning in 2010 due to the ongoing dispute over the Senkaku Islands, the lack of Japanese electronics making it back to the Chinese market forced them to rethink the embargo. However, such a view would ignore the forces of increasing global competition, both economic and potentially military.

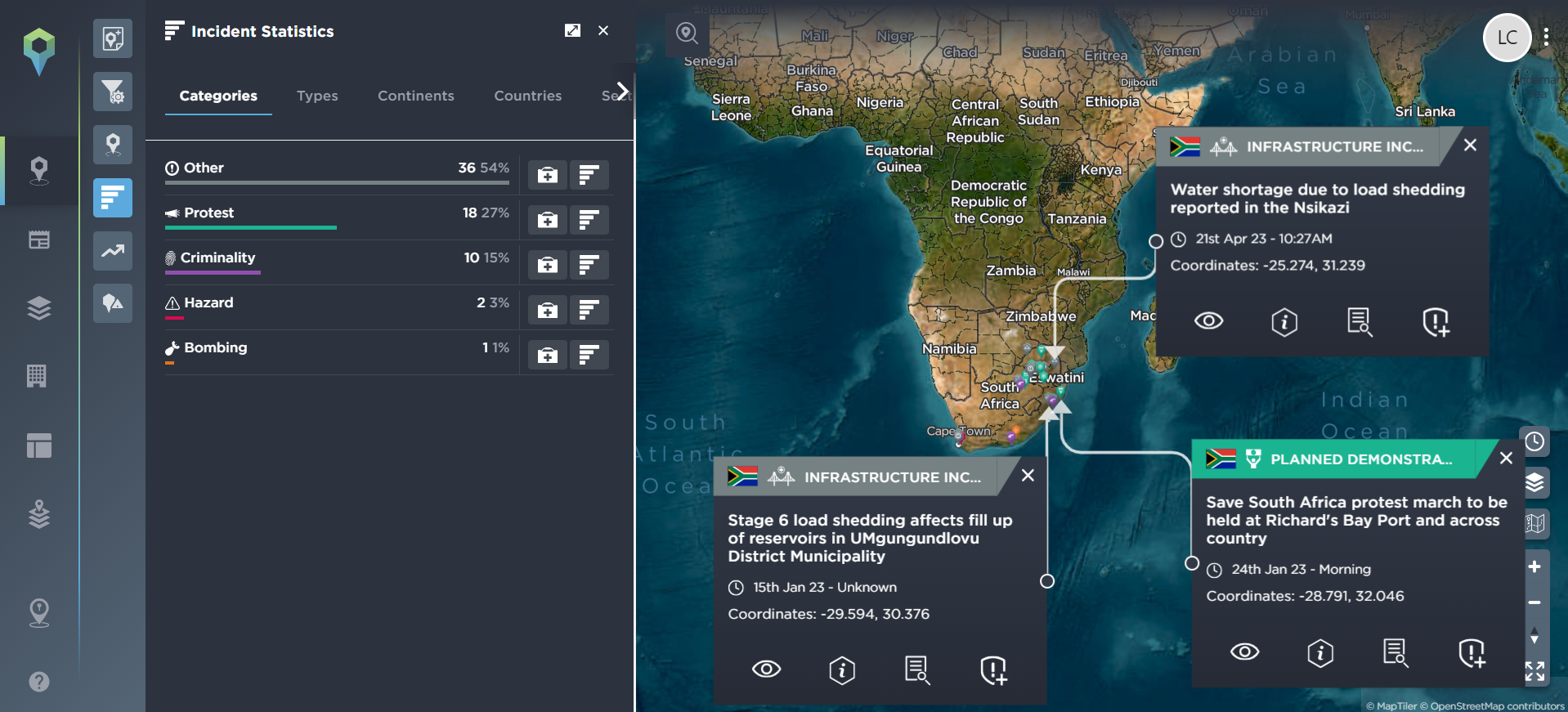

[Image source: Intelligence Fusion]

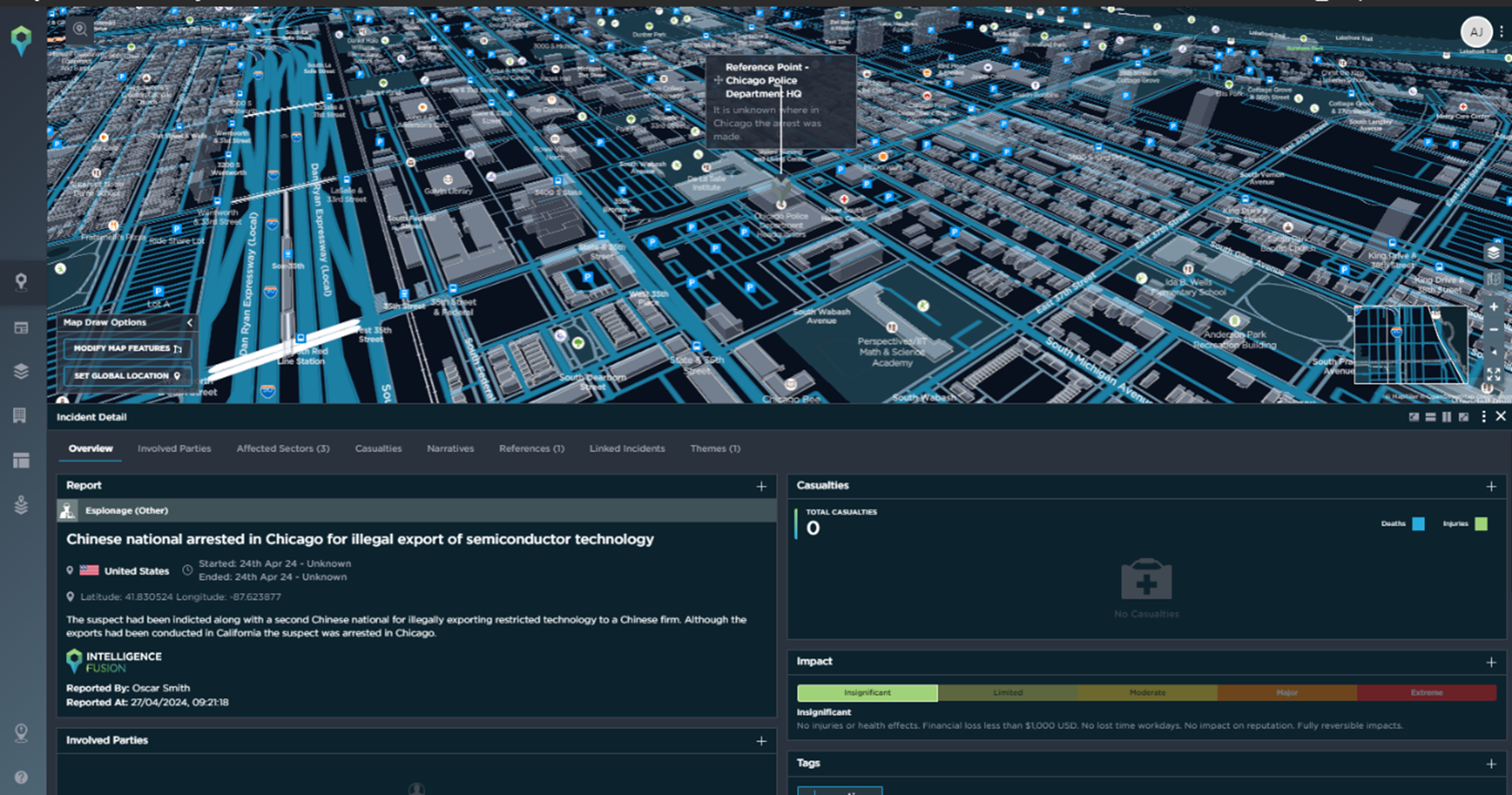

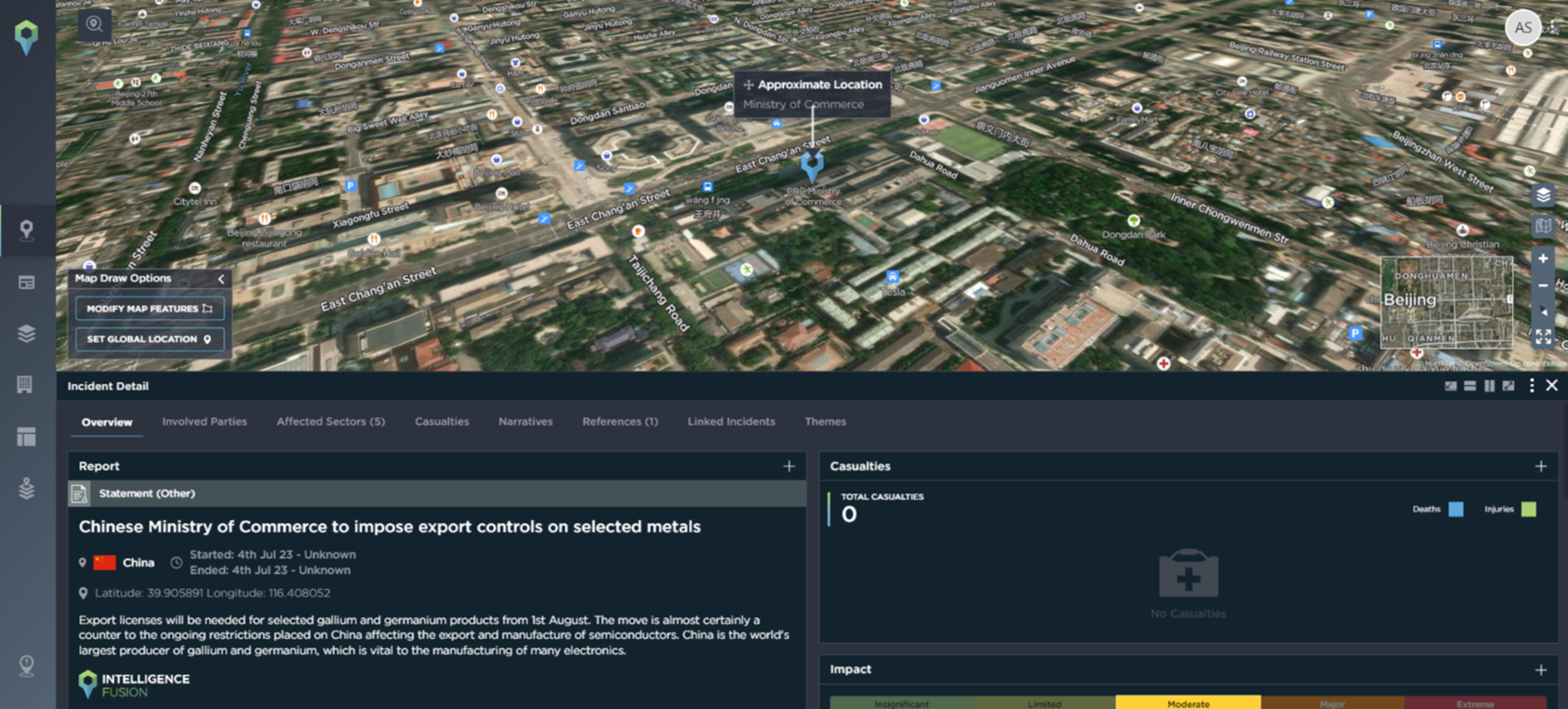

In addition to the 2010 incident with Japan, China has already shown a willingness to leverage its position to restrict the supply of other elements in response to political developments. In July 2023, China announced it would bring in a special license to export gallium and germanium – two metals needed for semiconductor production – abroad in a move widely regarded as a response to the US CHIPS Act. More recently, China announced export controls on antimony, another substance vital to the production of electronics, solar panels, batteries and more. It should be noted that while it is easy to see such incidents through the lens of US-China competition, such restrictions may be the result of market demands within China. China will understandably prefer the needs of Chinese manufacturers and consumers over that of those abroad, and as demand for EVs and renewable energy production increases at home, more of the world’s finite REE supply will become unavailable to Western countries, great power competition or no.

What is being done?

One of the main drivers likely to bring about change to the current Chinese dominance is the concern of the US military. The fact that the technological dominance that the US military has enjoyed for decades rests on components made almost exclusively by their primary strategic competitor has finally led to moves to improve domestic production of refined REE. Likewise, in the EU, the near total dependence on China in industries such as EV manufacturing has led the EU to announce targets for domestic REE production to be met by 2030, having allowed the industry to all but disappear in the face of environmental concerns and cheaper products from China in the 1990s.

However, while encouraging first steps, it seems highly unlikely that either the US or the EU will be able to diversify enough away from China to mitigate risks, at least in the short to medium term. While there are REE deposits in the Balkans and large amounts in Greenland, it seems unlikely that the EU will be able to overcome environmental opposition, not to mention its own carbon emission ambitions, to realise these targets.

[Image source: Intelligence Fusion]

Large potential REE deposits remain elsewhere in the world, but here again, Western countries have come up against stumbling blocks. A decade ago, it was estimated that the DPRK had huge reserves of LREE close to the Chinese border, but for obvious reasons, it is unlikely that anyone but China or Russia will ultimately exploit them. Myanmar is a significant producer of REE, not least the rare elements of dysprosium and terbium found in ionic clays in Kachin, but with China already involved in exploiting this wealth, and what Western interests there were having long fled the war-ravaged country, these too are unlikely to fall into Western hands. A final example is Mongolia – while there are concerns over the quality of the ore, Mongolia has sought to pursue a skilful balancing act between its neighbours China and Russia while looking to the US as an export market. Unfortunately, geography is again a factor, and any significant exports from Mongolia would be reliant on Chinese ports or Russian trains to reach external markets – things likely to be unavailable in the event of a conflict between the US and China.

Conclusion

The REE researcher and writer Guillaume Pitron have likened many consumers’ views on REE since the 1990s to that of the so-called “cargo cults” of some Melanesian islanders – seeing that all Westerners had to do to make food and supplies arrive from the sky to clear landing strips and talk into radios would mimic the actions, expecting mana from heaven to arrive while not understanding the sheer scale and complexity of supply chains that culminated in arrival of a single US supply drop. Similarly, expectations that an order placed in the market will magically be filled in spite of intensifying geopolitical competition are equally misplaced. Today, the finite supplies of REE and the industries that rely on them are vulnerable to a myriad of disruptions, not least declining US-China relations, embargoes on Russia and continued war in Myanmar. Not understanding and mitigating the risks to the supply of REE vital to so many industries may not be something consumers, companies, or governments will be able to afford for long.

![Figure One: Incidents across the world involving or affecting the lithium industry [Image source: Intelligence Fusion]](https://www.intelligencefusion.co.uk/wp-content/uploads/2024/08/Lithium-pic-1.png)