Navigating the Geopolitics and Risks of Lithium: Essential Insights for a Carbon-Free Future

A review of the geopolitical importance of lithium in the global decarbonisation effort, with China dominating its supply chain. This blog underscores the need for strategic risk management as major powers like the U.S. and EU seek to reduce reliance on Chinese lithium amidst environmental and transportation challenges.

Introduction

Global stakeholders—whether states, businesses, or individuals—are increasingly seeking to transition to a carbon-free world to resist the encroaching impact of climate change. With transport alone being responsible for more than a quarter of the world’s carbon dioxide emissions, the appeal and demand for carbon-free (at the point of use) vehicles grows (Politico 2022). The production and supply of electric vehicles (EVs) thus grow to accommodate this demand. In conjunction, the demand for lithium—an essential component for EVs —follows a similar trajectory. Besides being used for EVs, it is also used for all manner of electronic devices. Yet the significance of lithium comes not only from the breadth and increasing applicability but also the geopolitics concomitant with it.

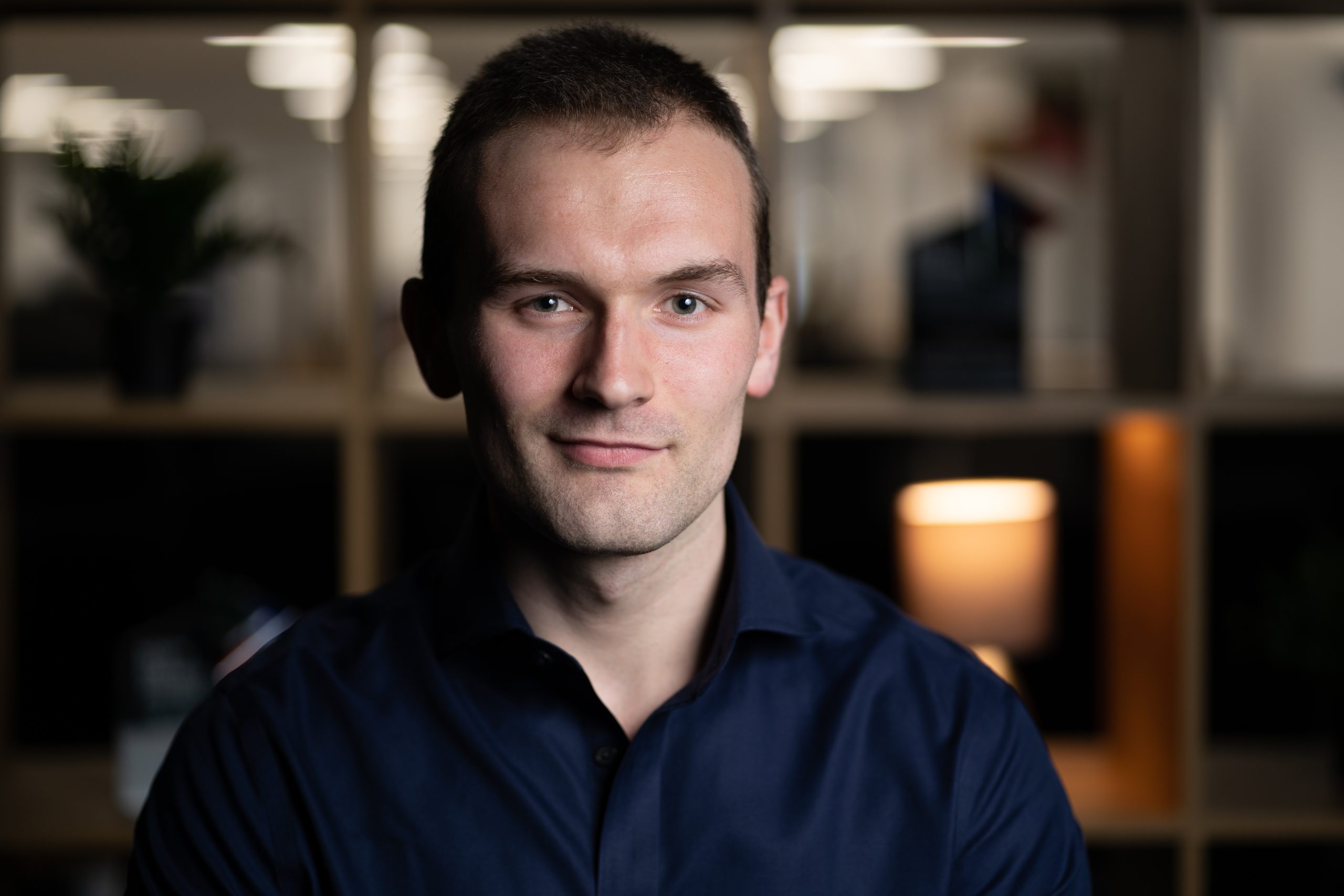

The importance of lithium being understood by security specialists such as managers and analysts in intelligence and risk is therefore pivotal. Intelligence Fusion’s own platform helps benefit this understanding further. This article seeks to showcase its strengths in understanding an emerging and complex industry. Besides this, it will also contextualise its current issues and what they could mean for the future of its supply chains.

![Figure One: Incidents across the world involving or affecting the lithium industry [Image source: Intelligence Fusion]](https://www.intelligencefusion.co.uk/wp-content/uploads/2024/08/Lithium-pic-1.png)

Figure One: Incidents across the world involving or affecting the lithium industry [Image source: Intelligence Fusion]

The ‘Great Game’ of lithium

Commodities and resources frequently contributed to the success of great powers via high shares of production and consumption. The United States, for example, has the greatest share of oil production and consumption in the world, with 22 per cent in production in 2023 and 20 per cent in consumption in 2022 (eia N/A). Likewise, lithium is unevenly distributed and monopolised by producers and consumers alike. Much like over 70 per cent of the world’s coltan residing within the Democratic Republic of Congo alone—its element Tantalum also being used for several technological devices—nearly 80 per cent of lithium resides in just four countries. These are Australia, Argentina, Bolivia, and Chile, the latter three of which are commonly referred to as the ‘lithium triangle’ of South America (The Interpreter 2023).

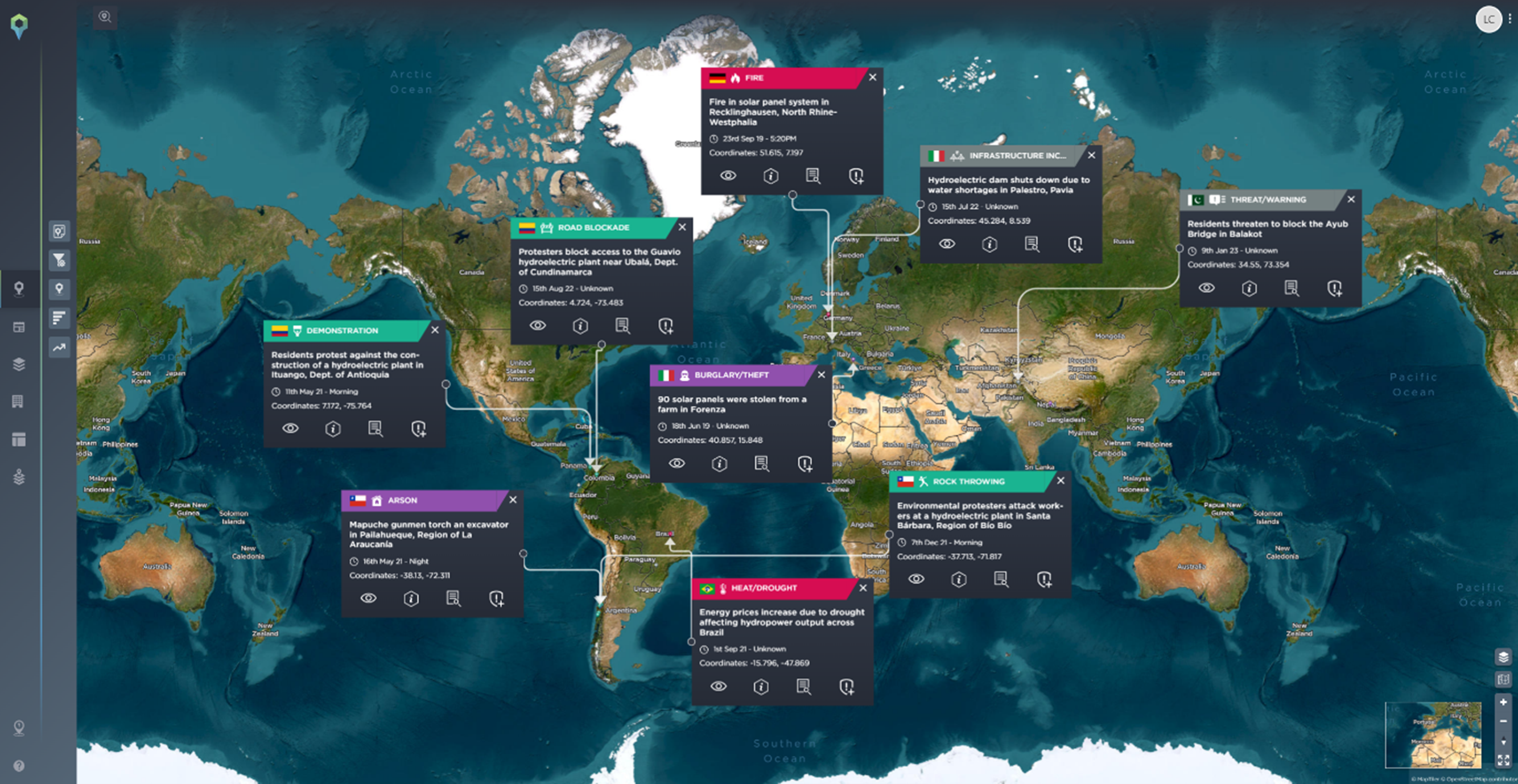

Figure Two: An incident involving the illegal extraction and trafficking of lithium [Image source: Intelligence Fusion]

However, the processing and redistribution of lithium resides in even fewer hands via the majority of consumption and the market share of the commodity belonging to China. Despite possessing less than 7 per cent of the world’s lithium reserves, China has purchased 70 per cent of lithium compounds, which, in turn, has allowed it to supply 70 per cent of global lithium production (The Interpreter 2023). In conjunction with its large share and influence over inputs of production such as capital and labour and global commodity prices, China has come to dominate the lithium supply chain (CSIS 2024).

State responses and risks to the lithium disparity

China’s preeminent role in the lithium market has raised concerns for other powers such as the United States, especially due to lithium’s new role as the new, so-called ‘white oil’ (The Guardian 2020). While the US is among the great powers to possess a portion of the world’s biggest lithium deposits—at least 14 million metric tonnes according to the US Geological Survey—most of it is untapped, with only one operational lithium mine in the entire US (wbur 2024). Under the Biden administration, the US seeks to rectify its lithium production deficit via the Inflation Reduction Act (IRA) introduced in 2022. The IRA aims to promote decarbonisation by providing subsidies and tax credits for producers of electricity generation derived from renewable energy. This includes the lithium industry due to its contribution to batteries and the electric vehicle (EV) sector (Frontier N/A). In total, the IRA has spent USD 396 billion of government money on subsidies for green technologies (The Guardian 2023). Simultaneously, it would reduce the lithium production gap between China and the US. This has been acknowledged by the Biden administration itself. During a tour of a lithium-ion battery production plant in Nevada owned by the American Battery Technology Company (ABTC), US Energy Secretary Jennifer Granholm noted how the introduction of 19 companies in the lithium industry in the area had occurred due to the IRA—providing the opportunity ‘to be able to compete with China.’ ABTC had also received a USD 115 million grant from the US Department of Energy under the IRA (Foreign Policy 2024).

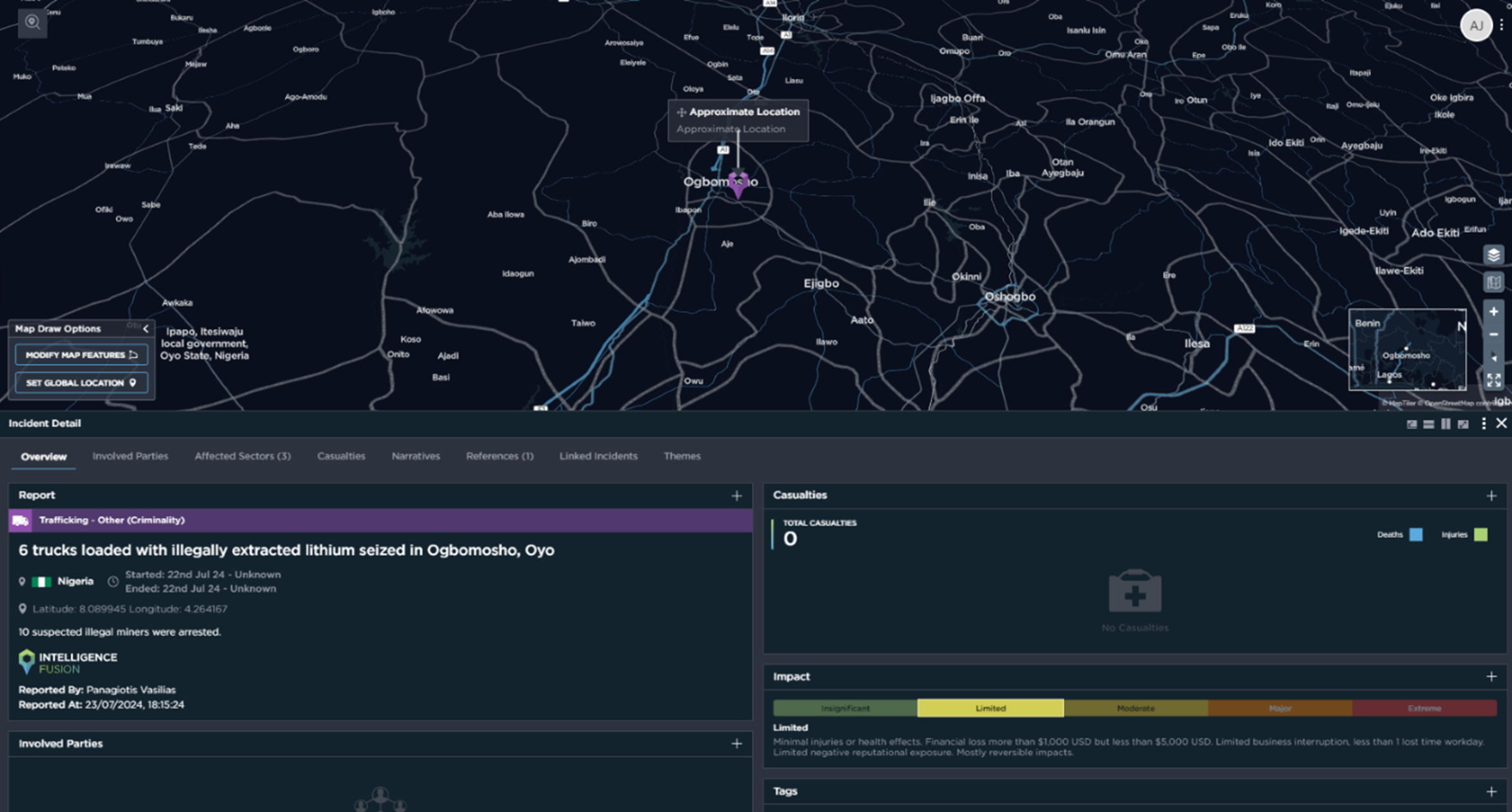

![Figure Three: Protest at Thacker Pass lithium mine, the largest known deposit in the US [Image source: Intelligence Fusion]](https://www.intelligencefusion.co.uk/wp-content/uploads/2024/08/Lithium-pic-3.png)

Figure Three: Protest at Thacker Pass lithium mine, the largest known deposit in the US [Image source: Intelligence Fusion]

The US is not the only nation that has responded to the lithium disparity presented by China. Inspired by—while simultaneously seeking to compete against—Biden’s new policies, the EU has introduced its own strategy to encourage green investment and increase its stake in the lithium market. During the World Economic Forum in January 2023, the EU Commission President Ursula von der Leyen announced that the EU would temporarily ease restrictions on green subsidies and increase investments into strategic climate-friendly businesses (Financial Times N/A). This later amounted to the introduction of the Critical Raw Materials Act in March 2023 (European Commission 2023), which seeks ‘to ensure the EU’s access to a secure, diversified, affordable and sustainable supply of critical raw materials’ via an increase in domestic capacities by 2030. Sceptics believe this strategy will be largely unsuccessful, especially with the EU accounting for under 1 per cent of the global lithium supply as of 2023. However, analysts have predicted that Europe may account for more than 25 per cent of battery-grade lithium demand by 2030—with China accounting for 40 per cent. Regardless, the EU would remain highly dependent on imports to source its predicted increase in lithium (MMTA 2023).

![Figure Four: Historical and recent protest against lithium mining in Serbia [Image source: Intelligence Fusion]](https://www.intelligencefusion.co.uk/wp-content/uploads/2024/08/Lithium-pic-4.png)

Figure Four: Historical and recent protest against lithium mining in Serbia [Image source: Intelligence Fusion]

Outside the EU, non-EU states within Europe have been seeking to benefit from the emerging lithium market, particularly Serbia. In June 2024, Serbian President Aleksandar Vucic stated that his government was going to approve the Jadar mining project after previously being halted by protests led by environmental groups in 2022 (euronews 2024). If established, it would become Europe’s largest lithium mine. Further protests have also continued into 2024, with one held in Belgrade on the 10th August by the Eco Guard and the ‘Ne damo Jadar’ group (CdM 2024). Similar protests have also been found across the world, whether they are in solidarity with Serbia’s protests or for campaigns against lithium mining in regions such as the lithium triangle in South America due to the local environmental costs of extracting lithium. This not only showcases the geopolitical ramifications of lithium but also its potential for social unrest that can disrupt businesses and logistics alike.

![Figure Five: Historical and recent protests against lithium mining across the world [Image source: Intelligence Fusion]](https://www.intelligencefusion.co.uk/wp-content/uploads/2024/08/Lithium-pic-5.png)

Figure Five: Historical and recent protests against lithium mining across the world [Image source: Intelligence Fusion]

The business risks of lithium’s transportation

With the importance and value of lithium increasing alongside its applicability, so too do the risks that are associated with the metal. This not only consists of protests like those previously highlighted but also inherent risks that directly harm lithium in transit. The high chemical volatility of lithium has led to several incidents which have heavily disrupted the transportation of other cargo besides causing direct harm to human and material assets. An example of this was the fire on the Freemantle Highway car carrier near Ameland, The Netherlands, on the night of 25th July 2023. Having killed one person and injured 16 others, among the cargo of 2,857 vehicles were 498 EVs, which are believed to have either caused or—at the very least—exacerbated the fire. The risks of transporting lithium consist of the threats directed at it due to its status as a valuable commodity, as well as the hazards possessed by the metal itself that can threaten other goods and business interests.

![Figure Six: The fire on the Freemantle Highway, which was transporting electric vehicles among its cargo [Image source: Intelligence Fusion]](https://www.intelligencefusion.co.uk/wp-content/uploads/2024/08/Lithium-pic-6.png)

Figure Six: The fire on the Freemantle Highway, which was transporting electric vehicles among its cargo [Image source: Intelligence Fusion]

The lithium supply chain is poised to become a central focus in the geopolitical landscape as its significance continues to grow alongside the global push for decarbonization. The intense competition among major powers, coupled with the inherent risks associated with lithium extraction, processing, and transportation, underscores the need for comprehensive intelligence and risk management strategies. As the world transitions to a more sustainable future, stakeholders must navigate these complexities with a keen understanding of the geopolitical dynamics at play. Tools like Intelligence Fusion’s platform will be indispensable in providing the insights needed to anticipate and mitigate the challenges ahead, ensuring a secure and resilient business environment. To discover more, secure your free trial of the Intelligence Fusion platform today.